Get the free ct 6 form

Show details

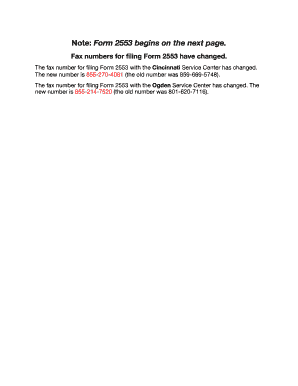

New York State Department of Taxation and Finance Instructions for Form CT-6 CT-6-I Election by a Federal S Corporation to be Treated as a New York S Corporation General information A federal S corporation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ct 6 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct 6 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct 6 form online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form ct 6. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out ct 6 form

How to fill out the CT 6 form:

01

Gather all required information and documents such as personal identification, income statements, and any supporting documents needed for the form.

02

Carefully read and understand the instructions provided on the CT 6 form. Familiarize yourself with the sections and requirements.

03

Start filling out the form by entering your personal information, such as your full name, address, and contact details in the designated fields.

04

Follow the instructions for each section of the form. Provide accurate and complete information based on your specific circumstances. Complete all necessary fields, including those related to income, deductions, exemptions, and credits.

05

Double-check all the information entered to ensure accuracy and avoid any potential errors.

06

Review any attachments or additional forms required for the CT 6 form. Attach supporting documents as instructed.

07

Sign and date the form in the appropriate places.

08

Make a copy of the completed form and all accompanying documents for your records.

09

Submit the CT 6 form and any required documents to the appropriate agency or authority as instructed.

Who needs the CT 6 form:

01

Individuals or households who are required to file state income taxes.

02

Business owners or self-employed individuals who need to report their income and expenses related to their business.

03

Anyone who has received any income or has tax liabilities in the state where the CT 6 form is applicable.

04

Individuals or entities claiming certain deductions, exemptions, or credits that are only available through the CT 6 form.

05

Individuals or entities who have had any changes in their taxable status or need to make corrections to previous filings.

Please note that the specific eligibility and requirements for filing the CT 6 form may vary depending on the jurisdiction and applicable tax laws. It is always recommended to consult with a tax professional or the relevant tax authority for accurate and personalized guidance.

Fill ny ct 6 fillable : Try Risk Free

People Also Ask about ct 6 form

Is form 1120 for C Corp or S corp?

What is the form for S Corp?

What is the difference between an LLC and an S Corp?

Where do I send my CT 6 form?

Is form 1120 an S corp?

What is a CT 6 form?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form ct 6?

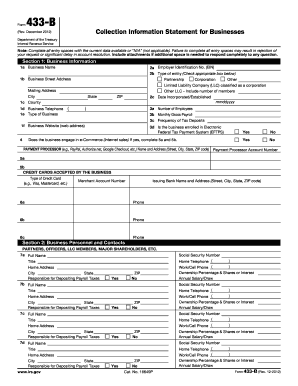

Form CT-6 is the short form or the Business Corporations Tax Short Form Return form used by corporations in the state of Connecticut to file their annual corporate tax return. This form is filed by eligible smaller corporations with gross revenues below a certain threshold. Form CT-6 is used to report their income, deductions, and calculate their tax liability for the tax year. The form requires information such as the company's name, address, federal employer identification number (FEIN), and details about their income and expenses.

Who is required to file form ct 6?

Form CT-6 is required to be filed by all domestic and foreign corporations that are subject to the Connecticut corporation business tax. This includes any corporation that is doing business in Connecticut, whether it is incorporated or not, and whether it is actively conducting business or temporarily inactive.

How to fill out form ct 6?

To fill out Form CT-6, follow these steps:

1. Start by filling in the basic information at the top of the form, including your name, address, and taxpayer identification number.

2. Check the appropriate box to indicate whether you are filing a new or amended CT-6 form.

3. Provide the effective date of the entity you are filing for. This is the date when the entity started doing business in Connecticut or the date it registered with the Secretary of the State.

4. Indicate the type of entity you are filing for by checking the appropriate box (Corporation, Partnership, LLC, or Other).

5. Enter the complete mailing address of the entity.

6. If the entity is a corporation, indicate the state or country where it was initially formed and the date of formation.

7. Provide a brief description of the principal business activity the entity engages in.

8. Indicate the filing basis by checking the appropriate box. This refers to whether the entity is filing based on a federal election, federal requirement, or is electing to be treated as a disregarded entity.

9. If applicable, provide the date of the federal election, the federal form number, and the federal identification number.

10. If the entity has previously filed a Form CT-6, provide the entity's Connecticut tax registration number.

11. Sign and date the form, certifying that the information provided is true and accurate to the best of your knowledge.

12. Gather any supporting documentation required, such as federal forms or schedules, and attach them to the completed CT-6 form.

13. Make a copy of the completed form and supporting documentation for your records.

14. Mail the original form to the address provided on the Form CT-6 instructions, or submit it electronically if applicable.

Remember to consult the specific instructions provided with Form CT-6 and consult with a tax professional if you have any doubts or questions regarding the form or its completion.

What is the purpose of form ct 6?

Form CT-6 is used for non-profit organizations to request an exemption from Connecticut state sales and use tax. It is filed by organizations that are exempt from federal income tax under section 501(c) of the Internal Revenue Code and are requesting a Connecticut state tax exemption for sales and purchases.

What information must be reported on form ct 6?

Form CT-6, also known as the Connecticut Tax Registration, must be filled out to register a business with the Department of Revenue Services (DRS) in Connecticut. The following information must be reported on the form:

1. Business Information: This includes the legal name of the business, trade name (if applicable), Federal Employer Identification Number (FEIN), business start date, and the primary business activity.

2. Business Address: The physical and mailing address of the business must be provided.

3. Contact Information: The name, title, phone number, and email address of the primary contact person for the business.

4. Additional Contact Information: Contact information for the business owner, such as name, title, phone number, and email address.

5. Ownership Information: Details about the ownership structure of the business, including the names, addresses, Social Security Numbers (SSNs), and ownership percentages of all owners, partners, or corporate officers.

6. Tax Information: Information about other state tax accounts, if applicable, such as Sales and Use Tax, Withholding Tax, or Business Entity Tax accounts.

7. Authorized Representative: If someone other than the business owner will be handling tax matters, their information should be provided.

8. Signature: The form must be signed and dated by the business owner or authorized representative.

Please note that this is a general overview, and additional information or attachments might be required based on specific business circumstances. It is recommended to consult the Connecticut Department of Revenue Services or a tax professional for further guidance when completing Form CT-6.

What is the penalty for the late filing of form ct 6?

The penalty for the late filing of Form CT-6, which is the Connecticut Annual Return, is $50 for each month or part of a month that the return is late, up to a maximum penalty of $500.

Where do I find ct 6 form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the form ct 6 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit nys ct 6 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your new york ct 6, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete ct 6 instructions on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your ct6 form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your ct 6 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nys Ct 6 is not the form you're looking for?Search for another form here.

Keywords relevant to form ct 6 instructions

Related to form ct 6 pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.