Get the free ct 6 form

Show details

New York State Department of Taxation and Finance Instructions for Form CT-6 CT-6-I Election by a Federal S Corporation to be Treated as a New York S Corporation General information A federal S corporation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form ct 6

Edit your ct6 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form ct6 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ct 6 instructions form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ny ct 6 form

How to fill out the CT 6 form:

01

Gather all required information and documents such as personal identification, income statements, and any supporting documents needed for the form.

02

Carefully read and understand the instructions provided on the CT 6 form. Familiarize yourself with the sections and requirements.

03

Start filling out the form by entering your personal information, such as your full name, address, and contact details in the designated fields.

04

Follow the instructions for each section of the form. Provide accurate and complete information based on your specific circumstances. Complete all necessary fields, including those related to income, deductions, exemptions, and credits.

05

Double-check all the information entered to ensure accuracy and avoid any potential errors.

06

Review any attachments or additional forms required for the CT 6 form. Attach supporting documents as instructed.

07

Sign and date the form in the appropriate places.

08

Make a copy of the completed form and all accompanying documents for your records.

09

Submit the CT 6 form and any required documents to the appropriate agency or authority as instructed.

Who needs the CT 6 form:

01

Individuals or households who are required to file state income taxes.

02

Business owners or self-employed individuals who need to report their income and expenses related to their business.

03

Anyone who has received any income or has tax liabilities in the state where the CT 6 form is applicable.

04

Individuals or entities claiming certain deductions, exemptions, or credits that are only available through the CT 6 form.

05

Individuals or entities who have had any changes in their taxable status or need to make corrections to previous filings.

Please note that the specific eligibility and requirements for filing the CT 6 form may vary depending on the jurisdiction and applicable tax laws. It is always recommended to consult with a tax professional or the relevant tax authority for accurate and personalized guidance.

Fill

form ct 6 instructions

: Try Risk Free

People Also Ask about nys ct 6 form

Is form 1120 for C Corp or S corp?

C corporations: C corps are separately taxable entities. They file a corporate tax return (Form 1120) and pay taxes at the corporate level. They also face the possibility of double taxation if corporate income is distributed to business owners as dividends, which are considered personal taxable income.

What is the form for S Corp?

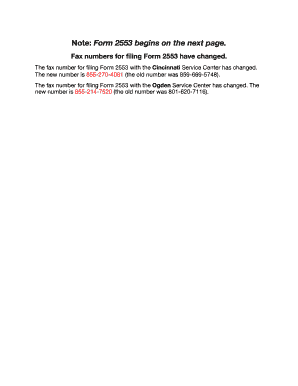

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.

What is the difference between an LLC and an S Corp?

The biggest difference between S corporations and LLCs is how they are taxed. S corporations are taxed as pass-through entities, meaning that the profits and losses are passed through to the shareholders' personal tax returns, while LLCs can choose to be taxed as either a pass-through entity or a corporation.

Where do I send my CT 6 form?

If you do not receive confirmation of your election before your return is due, you should write to: NYS Tax Department, Corporation Tax Account Resolution Unit, W A Harriman Campus, Albany NY 12227‑0852.

Is form 1120 an S corp?

A form 1120-S is the tax return form for businesses registered as S corporations, a type of corporation that avoids double taxation at both the corporate and personal level. S corps use this tax form to report any profits, losses, and deductions for that fiscal year.

What is a CT 6 form?

To officially be designated as an S corporation in New York, your business will be required to file a Form CT-6, which is the Election by a Federal S Corporation to be Treated as a New York S Corporation.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ny ct 6 form?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the ny form ct 6 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit nys form ct 6 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your new york form ct 6, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete ct 6 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your nys ct 6 instructions. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is form ct 6?

Form CT-6 is a form used in Connecticut for the purpose of claiming exemption from Connecticut sales and use taxes for certain types of purchases or transactions.

Who is required to file form ct 6?

Organizations, businesses, or individuals who qualify for tax exemptions under specific Connecticut statutes are required to file Form CT-6.

How to fill out form ct 6?

To fill out Form CT-6, you should gather all required documentation, complete each section of the form accurately, provide necessary identifying information, and submit it to the appropriate tax authority.

What is the purpose of form ct 6?

The purpose of Form CT-6 is to provide a mechanism for qualifying entities to officially claim and receive tax exemptions on eligible purchases in Connecticut.

What information must be reported on form ct 6?

Report information such as the name and address of the entity claiming the exemption, details of the purchase, the type of exemption being claimed, and any relevant identification numbers.

Fill out your ct 6 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ny Ct 6 Instructions is not the form you're looking for?Search for another form here.

Keywords relevant to new york ct 6

Related to nys ct6

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.